When you think of long-term investing strategies, institutions like Yale University often come to mind. For decades, the “Yale Model” has been a beacon for endowments and foundations seeking to grow their wealth sustainably. But is this revered approach facing its demise in today’s rapidly evolving financial landscape?

“The Yale Model revolutionized how endowments invest.”

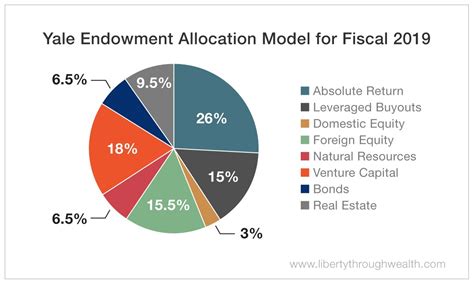

To understand the potential decline of the Yale Model, we need to delve into its origins and core principles. Back in the 1980s, David Swensen, Yale’s legendary Chief Investment Officer, pioneered a groundbreaking strategy that prioritized diversification across various asset classes like private equity, real estate, and absolute return investments.

“Swensen’s strategy emphasized alternative investments over traditional stocks and bonds.”

This shift marked a departure from conventional portfolio management practices prevalent at the time. Swensen’s approach sought higher returns by venturing into less mainstream investment opportunities with potentially higher risks but also greater rewards.

As other institutional investors took notice of Yale’s remarkable success under Swensen’s guidance, many began adopting variations of the model. The idea was simple yet radical – move away from relying solely on public equities and fixed income securities towards a more diversified mix that could weather market volatility and deliver superior long-term results.

“The Yale Model inspired a wave of endowments to rethink their investment strategies.”

However, as global markets witness unprecedented changes driven by factors like technological advancements, geopolitical shifts, and economic uncertainties – some experts question whether the traditional Yale Model can adapt effectively to this new reality.

In recent years, critics have pointed out potential flaws in the model’s reliance on illiquid assets during times of crisis when liquidity becomes paramount. The COVID-19 pandemic served as a stress test for many portfolios following similar approaches to Yale’s – revealing vulnerabilities that were not as pronounced during periods of relative market stability.

“The pandemic exposed weaknesses in portfolios heavily invested in illiquid assets.”

Moreover, with interest rates at historic lows and inflation concerns looming large, the efficacy of sticking to an allocation strategy heavily skewed towards alternatives comes into question. Traditional asset classes are experiencing significant fluctuations while newer assets like cryptocurrencies present both opportunities and risks that weren’t part of Swensen’s original blueprint.

To shed light on these challenges facing the Yale Model and its disciples, we turned to renowned financial strategist Dr. Emily Collins for her insights:

Dr. Emily Collins: “While the core tenets of diversification and long-term thinking embedded in the Yale Model remain relevant today, investors must also factor in evolving market dynamics. Flexibility is key – being able to pivot swiftly based on changing conditions without losing sight of your overarching investment goals.”

Collins’ advice underscores the importance of balancing time-tested strategies with adaptability in an ever-changing investment landscape. The allure of alternative investments may still hold promise for those willing to weather uncertainties but recalibrating risk management practices could be imperative moving forward.

As endowment funds reevaluate their investment approaches post-pandemic recovery phases amid ongoing geopolitical tensions and economic shifts worldwide – one thing remains certain: honoring David Swensen’s pioneering spirit means not just replicating his strategy blindly but innovating upon it with a keen eye on emerging trends shaping tomorrow’s markets.

In conclusion, while rumors swirl about the demise of the famed Yale Model amidst modern-day challenges – perhaps its true legacy lies not just in what it was but how it continues inspiring future generations of investors to strike a delicate balance between tradition and transformation in pursuit of lasting financial success.

Leave feedback about this