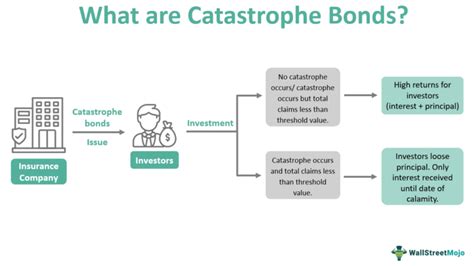

Have you ever heard of catastrophe bonds? Well, they are not your typical investment vehicle. Imagine securities issued by insurers, reinsurers, and governments to transfer risk from large-scale disasters like hurricanes, wildfires, storms, and earthquakes. These unique bonds offer double-digit yields but come with a catch – buyers have to bear losses beyond a predetermined threshold.

Now picture this – a new exchange-traded fund (ETF) has emerged on the scene, revolutionizing the way investors can tap into this unconventional asset class. The Brookmont Catastrophic Bond ETF (ILS) is making waves as it delves into cat bonds associated with random natural disasters. Ethan Powell, the chief investment officer of Brookmont Capital Management in Texas, describes these bonds as

“a low-correlation, high-yield alternative to traditional bonds,”

offering investors an opportunity for income diversification.

The global market for catastrophe bonds has ballooned to an impressive $52 billion according to Artemis.bm. Until now, asset managers like Pimco and Schroders have offered mutual funds focusing on cat bonds. However, ETFs providing exposure to this market have been notably absent due to concerns surrounding liquidity. Cat bonds are usually traded over-the-counter and held until maturity by their owners.

Steve Evans from Artemis.bm highlights that while discussions around daily liquidity in cat bond markets persist, most funds offer weekly or monthly liquidity options due to perceived illiquidity issues within the market.

With the launch of the actively managed Brookmont fund comes new strategies for managing liquidity risks associated with cat bond investments. Powell emphasizes the importance of maintaining liquidity buffers within the fund and implementing cash creations or redemptions during periods of heightened outflows.

As interest rates rise globally since 2022, cat bonds currently yield around 10.5%, presenting an attractive prospect for investors seeking higher returns uncorrelated with traditional assets like stocks and bonds.

Bryan Armour from Morningstar acknowledges the appeal of cat bonds as they offer similar returns to high-yield bonds but without direct correlation to interest rate fluctuations. Nonetheless, he raises caution regarding investor comprehension of idiosyncratic risks inherent in cat bond investments.

Evans echoes similar concerns about market depth and investor appetite towards expanding this niche asset class through ETFs like ILS which boasts a total expense ratio of 1.58% tailored primarily for smaller institutional investors.

In conclusion, venturing into the world of catastrophe bond investments via ETFs opens up a realm of opportunities previously reserved for private investors. With careful management strategies in place addressing liquidity challenges and educating investors on underlying risks involved in these unique securities could pave the way for broader adoption in diversified portfolios.

Leave feedback about this