China’s recent surge in green bond issuance has reverberated across the global financial landscape, sending a clear and impactful message. These bonds are not just about finance; they represent a country’s commitment to environmental sustainability on a grand scale.

“The shift towards green bonds reflects China’s growing focus on sustainable development.”

In the heart of Beijing, where modern skyscrapers stand juxtaposed against ancient temples, the buzz of financial markets is palpable. Investors and analysts alike are abuzz with chatter about China’s latest move – issuing an unprecedented volume of green bonds. But what exactly are green bonds, and why are they creating such a stir?

Green bonds are a specialized type of fixed-income instrument specifically earmarked to raise money for projects that have positive environmental or climate benefits. This includes initiatives like renewable energy projects, sustainable water management systems, or eco-friendly transportation infrastructure. The proceeds from these bonds are dedicated solely to funding “green” projects.

“China’s green bond market is poised to drive significant change in environmental financing.”

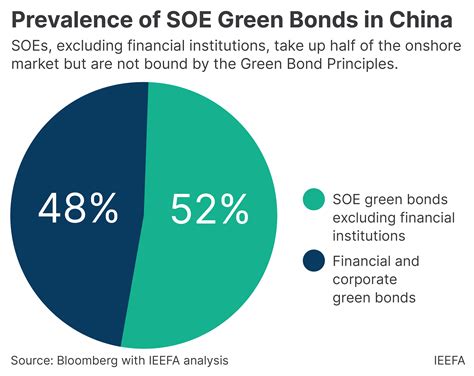

Experts suggest that China’s push towards green finance isn’t merely symbolic; it represents a tangible shift towards prioritizing sustainability in economic development. With the largest population globally and an economy experiencing rapid growth, China wields considerable influence over global markets – making their commitment to green finance even more impactful.

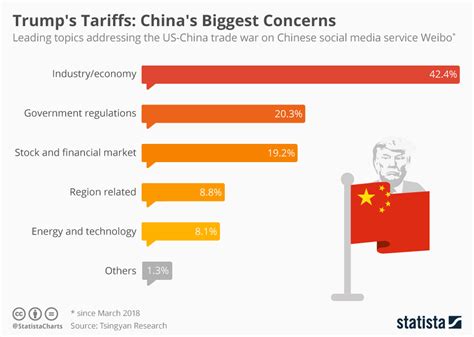

As I delved deeper into conversations with industry insiders, one theme became abundantly clear: the timing of China’s foray into green bonds is no coincidence. The world at large is grappling with pressing environmental challenges like climate change and resource depletion. By embracing green finance now, China positions itself as a leader in combating these issues head-on.

“China’s embrace of green finance signals a pivotal moment in global sustainability efforts.”

The implications of this pivotal decision extend far beyond Chinese borders. As one analyst pointed out during our discussion, “China has the potential to set new standards for environmentally responsible investing worldwide.” By integrating sustainable practices into its financial framework, China not only mitigates risks associated with climate change but also sets an example for other nations striving for ecological balance.

Picture this: bustling cities adorned with solar panels glistening under the oriental sun; lush forests breathing life back into once-barren lands; rivers running clean and clear through verdant landscapes – this vision painted by proponents of green finance offers a glimpse into what our future could hold if we prioritize sustainability today.

“The narrative around Chinese green bonds signifies a monumental paradigm shift in global finance.”

While some skeptics may view China’s move as purely strategic or economically driven, there is no denying the profound impact it will have on shaping our planet’s future trajectory. The adoption of green bonds signals not just an evolution in financial instruments but also underscores a fundamental transformation towards greener economies worldwide.

So next time you hear whispers of China’s burgeoning green bond market or catch wind of their ambitious sustainable initiatives, remember – behind every bond sold lies a promise for a brighter, more environmentally conscious tomorrow.

Leave feedback about this