Another Anti-Corruption Pillar Crumbles: The Unraveling of the Corporate Transparency Act

In the hustle and bustle of Washington, D.C., a man walks through the grand doors of the U.S. Treasury Department. Little did he know that inside those walls, a decision was being made that would send shockwaves through the business world. It all started with a simple social media exchange between tech mogul Elon Musk and comedian Terrence K. Williams.

Williams, in a plea to Musk, highlighted the burden imposed by what he called a “ridiculous” rule created under President Biden’s administration. The Beneficial Ownership Information (BOI) reporting requirement had stirred controversy, especially among conservatives and small businesses feeling its weight.

Musk’s casual response sparked a chain reaction leading to significant changes in U.S. anti-money laundering policies – changes that would have profound implications for businesses across the nation.

Less than 24 hours after Musk’s tweet, the U.S. Treasury Department made an unprecedented announcement via social media platforms – they would no longer enforce penalties or fines related to the Corporate Transparency Act (CTA). This act aimed to reveal the true owners behind companies and eliminate anonymous shell corporations within U.S. borders.

The sudden shift in enforcement left many bewildered – from small business owners trying to navigate complex regulations to experts concerned about the ramifications on national security efforts against money laundering and terrorism financing.

“The ability to form anonymous shell companies has long been exploited.”

Behind this legal saga lies decades of bipartisan effort to combat financial crimes facilitated by hidden corporate structures. The journey towards passing the CTA was fraught with challenges but garnered support from various quarters including law enforcement agencies like the Fraternal Order of Police and advocates for transparent governance practices.

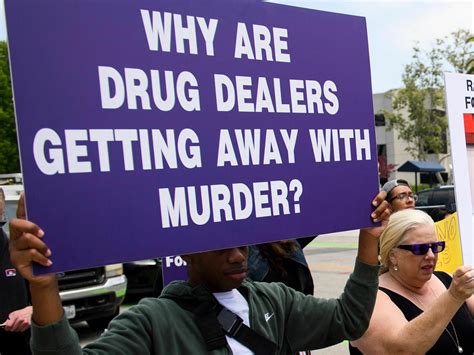

The rise of anonymous shell companies as vehicles for illicit activities drew global attention following high-profile leaks like the Panama Papers and Pandora Papers. These revelations underscored how easily criminals could exploit corporate secrecy laws for nefarious purposes ranging from drug trafficking to corruption schemes.

Amidst mounting pressure, Congress took decisive action by passing the CTA in 2021 – signaling a monumental step towards aligning with international standards on combating money laundering and terrorist financing.

However, recent developments have thrown this progress into disarray as regulatory chaos looms over businesses grappling with uncertain compliance requirements under suspended enforcement measures.

Expert Analysis:

Renowned experts caution that suspending CTA enforcement not only weakens anti-money laundering efforts but also jeopardizes U.S. compliance with global standards set by entities like FATF.

They emphasize that such policy shifts could have far-reaching consequences beyond domestic borders, potentially tarnishing America’s reputation in international financial circles.

As stakeholders await further clarity on this evolving situation, one thing remains certain – restoring transparency and accountability within corporate structures is paramount not just for economic stability but also national security interests.

Leave feedback about this