Anti-corruption efforts are critical pillars in maintaining the integrity of businesses and governments. However, when these foundations begin to crumble, the repercussions can be far-reaching and severe.

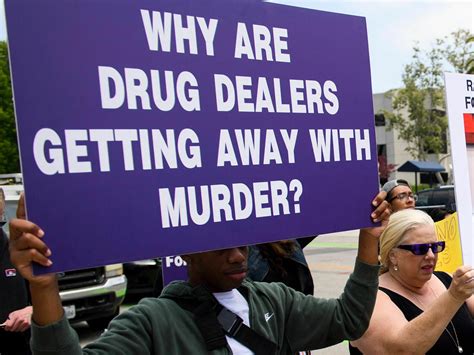

In a recent turn of events, the decision not to enforce the Corporate Transparency Act has sent shockwaves through the U.S. business landscape. This move not only poses challenges for American enterprises but also potentially facilitates illegal activities such as drug trafficking.

The spark that ignited this controversy came from an unexpected source: a social media interaction between tech mogul Elon Musk and comedian Terrence K. Williams. Williams raised concerns about the burdensome nature of the Beneficial Ownership Information (BOI) rule, attributing it to President Biden and calling for its removal.

This online exchange set off a chain reaction leading to significant policy changes in anti-money laundering and counterterrorism financing practices within the United States. The subsequent regulatory confusion has particularly impacted small businesses across the nation.

“The CTA is one of the most important AML/CFT laws passed in decades.”

The Corporate Transparency Act represents a crucial step in combating financial crimes by requiring companies to disclose their ultimate owners and prohibiting anonymous shell companies. Despite facing initial resistance, bipartisan support eventually saw its enactment into law during Trump’s administration.

Numerous high-profile leaks over the years have shed light on how anonymous entities can be exploited for illicit purposes like money laundering and corruption. The global community has been increasingly emphasizing transparency in beneficial ownership as a key tool against financial wrongdoing.

However, with recent developments suspending enforcement of this essential legislation, concerns have arisen regarding its broader implications. Not only does this decision jeopardize U.S. compliance with international standards but it also contradicts previous executive orders aimed at enhancing national security measures.

“Providing basic information on company beneficial ownership is a simple matter.”

Efforts to streamline beneficial ownership reporting processes have been met with mixed reactions, ranging from logistical challenges to privacy considerations. While some argue that compliance is straightforward for most companies, others express reservations about potential burdens on small businesses.

The freeze on Corporate Transparency Act enforcement not only raises questions about U.S. commitment to anti-money laundering initiatives but also threatens repercussions on an international scale. Failure to align with Financial Action Task Force standards could result in adverse consequences for American entities engaging in global transactions.

In essence, overlooking the importance of beneficial ownership disclosure undermines longstanding efforts to combat financial crimes and protect national interests. As stakeholders grapple with this policy shift’s ramifications, restoring clarity and consistency in anti-corruption measures remains paramount for upholding ethical business practices.