As I walked back into the office post-Christmas break, a startling headline caught my eye –

“Panic as Aussie dollar crashes to five-year low.”

Immediately, thoughts of rushing to stock up on canned goods flooded my mind. But let’s take a step back and dissect this alarming news.

Economic fluctuations can be unnerving, especially when tied to global events like the looming specter of Trump’s potential tariffs on Chinese imports. This uncertainty has led to a dip in the Australian dollar’s value, often linked to China’s economic performance due to our substantial iron ore exports there.

The Reserve Bank of Australia (RBA) has highlighted that the recent drop in the dollar is primarily influenced by the robust US currency and concerns surrounding China’s economic outlook. It’s essential to understand that these shifts are not solely driven by domestic factors but are part of a larger global economic narrative.

“It’s simply that when the two biggest economies in the world start splashing around in the economic pool, Australia often gets wet.”

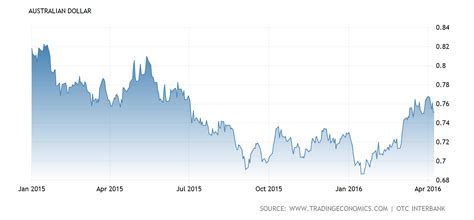

While it may be easy to succumb to panic over exchange rate fluctuations, especially for those heavily reliant on market movements, for most individuals, these changes have minimal immediate impact. Over the past year or so, we’ve seen a gradual decline in the Australian dollar compared to its historical averages but not a catastrophic crash by any means.

An extended look at exchange rate trends over 25 years provides valuable context. The Australian dollar has experienced highs and lows with no definitive pattern tying its strength or weakness to overall economic prosperity.

A weaker Australian dollar can have varied effects on different sectors of our economy – benefiting exporters while posing challenges for importers. Industries like tourism may see an uptick as overseas travel becomes more affordable with a lower exchange rate, while businesses relying heavily on imports might face increased costs and inflation pressures.

“Australians will feel the impact most notably in petrol prices.”

One area where Australians are likely to feel this shift acutely is at petrol stations. As the Australian dollar depreciates against major currencies like USD, imported goods such as oil become more expensive domestically. This rise in import costs could contribute to higher inflation rates if left unchecked.

However, amidst all this uncertainty, it is crucial for policymakers like RBA not to lose sight of our domestic economic landscape. While interest rates do influence exchange rates indirectly by attracting foreign investments based on relative returns, addressing broader economic challenges requires a holistic approach beyond just monetary policy adjustments.

“The RBA needs to focus on the domestic economy.”

Recent inflation figures suggest that there is room for rate cuts without compromising stability or growth prospects. With market expectations aligning towards potential rate adjustments in response to evolving economic conditions rather than mere exchange rate fluctuations alone—there’s no need for undue alarm regarding short-term currency movements.

In conclusion, while headlines scream sensational stories about crashing currencies and financial turmoil abroad – it’s vital for everyday Australians not to get swept away by fear-induced reactions fueled by media narratives detached from broader economic realities.