Ah, the Bank of England. One of the oldest central banks in the world, with a history dating back centuries. But like all institutions, it’s not immune to missteps.

“Quantitative easing,” or QE for short, was meant to be a financial stimulus tool.”

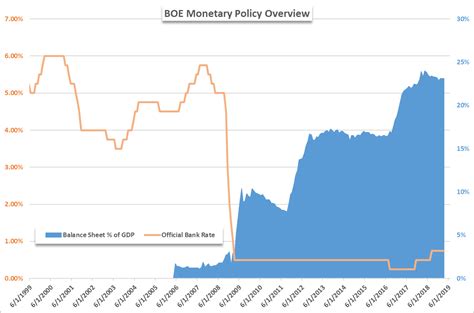

Picture this: The year is 2009, and the global financial crisis has hit hard. The UK economy is reeling from the impact, and policymakers are scrambling for solutions.

In comes quantitative easing – a term that sounds complex but essentially means pumping money into the economy to boost spending and investment. It was supposed to kickstart growth, lower borrowing costs, and prevent deflation.

“However, as time went on, flaws in the execution of QE began to surface.”

Experts argue that while QE did help prevent an even deeper recession in the UK, it also had unintended consequences. Let’s delve into where things might have gone wrong.

Imagine a scenario where injecting money into the economy doesn’t quite work out as planned. Some critics say that instead of flowing into productive investments like businesses or infrastructure projects, this fresh cash ended up inflating asset prices – think stocks and real estate.

“The bank found itself trapped in a cycle where it feared withdrawing support.”

As time passed, concerns grew about how to unwind QE without causing market upheaval or economic instability. The Bank of England had created such dependency on its stimulus measures that any hint of scaling back sparked fear among investors.

So why couldn’t they just hit reverse on QE? Well, it’s not as simple as pressing a button. Unwinding years’ worth of monetary accommodation requires finesse and careful planning to avoid shocks to the system.

“The challenge lay in finding the delicate balance between supporting growth and controlling inflation.”

Some argue that by keeping interest rates ultra-low for an extended period through QE, central banks inadvertently fueled asset bubbles and encouraged risky behavior among investors hungry for higher returns.

But hey, hindsight is always 20/20. In times of crisis, tough decisions must be made swiftly with imperfect information at hand. And let’s face it – there’s no playbook for navigating uncharted waters like a global financial meltdown.

Despite its shortcomings and criticisms, QE remains a significant chapter in modern monetary policy history. It taught us valuable lessons about the limits of intervention and the complexities of managing economic recovery post-crisis.

So here we are today looking back at where the Bank of England’s QE programme may have stumbled but also recognizing its role in averting what could have been an even more catastrophic outcome during those uncertain times.