The latest data on the inflation rate in April showed a slip to 2.1%, which was lower than what was initially expected. This decline has caught the attention of various experts and policymakers, especially against the backdrop of ongoing discussions around tariffs, trade policies, and monetary decisions.

President Trump’s persistent pressure on the Federal Reserve to lower interest rates reflects his eagerness to steer inflation back towards the central bank’s target of 2%. Despite this push, policymakers have maintained a cautious stance, emphasizing the need to assess the long-term implications of current trade policies before making any significant moves.

In response to Trump’s tariff strategies, Oliver Allen, a senior economist at Pantheon Macroeconomics, highlighted potential future challenges. He pointed out that

“much bigger increases in core goods inflation probably loom as the costs of the new tariffs are eventually passed on.”

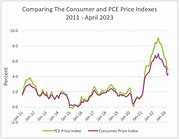

Allen predicted that core PCE (Personal Consumption Expenditures) inflation could peak later in the year between 3.0% and 3.5% if existing tariff structures remain unchanged.

The recent meeting between President Trump and Fed Chair Jerome Powell marked an important juncture in their relationship amid economic uncertainties. However, despite speculations, a statement from the Fed clarified that discussions about future monetary policies did not take place during their encounter. The statement also reiterated the Fed’s commitment to making decisions independent of political influences.

Trump’s imposition of across-the-board 10% duties on all U.S. imports aimed at addressing trade imbalances has stirred both domestic and international concerns. The subsequent introduction of higher selective reciprocal tariffs escalated tensions further but were later mitigated by negotiations with affected countries under a temporary truce.

Legal challenges have also emerged regarding Trump’s tariff actions, with courts questioning their legality and potential impact on national security and global trade dynamics. While uncertainties persist, economists raise alarms about possible inflationary effects triggered by tariffs which could disrupt price stability and economic growth patterns.

During their recent policy meeting, Federal Reserve officials voiced apprehensions about potential tariff-induced inflation risks amidst evolving labor market conditions. The specter of stagflation – a combination of high prices and sluggish economic growth – looms large as historical parallels draw comparisons to challenging economic periods like those witnessed in the early 1980s.

The intricate interplay between tariffs, monetary policy decisions, international trade dynamics offers complex insights into how these factors collectively influence inflation trends within an economy as diverse and dynamic as that of United States.

Leave feedback about this